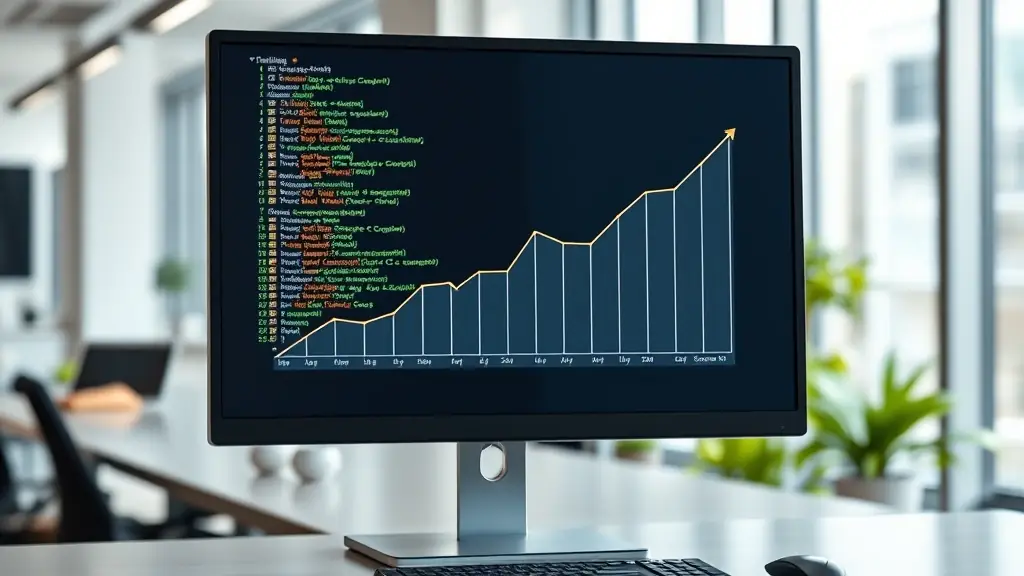

Python’s versatility extends far beyond web development. Its application in financial analysis is rapidly growing, providing investors with valuable tools for data-driven decision-making. This allows for more informed investment strategies, leading to potentially higher returns. Python’s ability to process large datasets is crucial for identifying trends and patterns in the market. By leveraging Python libraries like Pandas and NumPy, investors can efficiently analyze market data, identify potential investment opportunities, and assess risk factors. This data-driven approach to investment strategies is becoming increasingly important in today’s dynamic economic landscape. Python’s automation capabilities also streamline tasks, freeing up time for more strategic planning and analysis. This efficiency is key to maximizing returns in the long run. The use of Python in financial modeling allows for the creation of sophisticated models to predict market trends and assess the potential returns of various investment strategies. This predictive capability is invaluable for making informed decisions. Python’s open-source nature makes it accessible and cost-effective for investors of all levels. This accessibility is a key factor in its growing popularity within the financial community. The availability of extensive online resources and communities further supports the learning and application of Python in financial analysis.

Python for Financial Growth: Strategies for Success

Python is a powerful tool for financial growth, offering investors and businesses valuable insights for